coweta county property tax pay online

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Please use the link below to plan your visit.

Please call 770-254-2351 for payment of delinquent City taxes.

. If payment is made after 300 pm water will not be restored until the following business day. The Coweta County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. Coweta County GA.

101 East Central Ave. Coweta County is always looking at ways to expand your option to Pay Online and there are some online options which include Ambulance. The 2020 millage rate of 3643 was set by Council in August.

Post Date05102022 116 PM. The delinquent taxes can also be paid by check or in person at City Hall 25 LaGrange Street. Coweta-Fayette EMC offers several methods of payment.

Renew and pay tags via the. PO Box 99 Moultrie GA 31776-0099 HOME GENERAL INFO FAQS CONTACT US SEARCH PAY TAXES. Object Moved This document may be found here.

Pay Probation tag office. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Scheduling a payment online close to the due date if.

In addition Moodys assigned Coweta County an Aa1 rating to the Countys 35 million Revenue Bonds Series 2022 issued by the Countys Public. Bills may be paid using cash check Mastercard or Visa. Everyone visiting the County Administration Building is required to enter through the East Broad St entrance.

Pay EMS charges solicitor. On April 13 2022 Moodys Investor Services upgraded Coweta County from an Aa2 to Aa1 unlimited tax rating and from an Aa3 to Aa2 outstanding lease revenue rating. Website Design by Granicus - Connecting People and Government.

Whether you are already a resident or just considering moving to Coweta County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Pay traffic tickets State Court Probation. Local government GIS for the web.

Planning Development Ordinances. The Coweta County GA Website is not responsible for the content of external sites. Government Tax Information.

Welcome to our online payments website. Board of Tax Assessors Appraisal Office Coweta County GA Website. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263.

CLICK HERE to join the queue or set up an appointment. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. Thank you for visiting the Coweta County GA Website.

You may pay your bill any of our offices which are located in Newnan Fayetteville and Palmetto or you may simply mail in your payment. You will be redirected to the destination page below in 3. The Newnan City Council sets the millage rate each year in the summer based on digest information provided by Coweta County.

As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale matters. Notice to Property Owners Occupants. View and pay Utility Billing accounts online.

Coweta County Property Records are real estate documents that contain information related to real property in Coweta County Georgia. The following services are available. Use the Search and Pay Taxes link above to verify property tax payment received.

For after hours water and sewer emergencies call 770 254-3710. Each Ex-Officio Deputy She riff has full power to advertise and bring property to sale for the purpose of collecting taxes due the state and county. Georgia is ranked 841st of the 3143 counties in the United States in order of the median amount of property taxes collected.

Coweta County GA Website. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County. General pay PTD State Court.

Learn all about Coweta County real estate tax. Is there are any options for online payment of property taxes in Georgia County Coweta. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900.

On the day of cut-off please call the Utility Billing Clerk at 918486-2189 to verify the payment was received. Limited space is available in the lobby area. Payments may be made to the county tax collector or treasurer instead of the assessor.

They are maintained by various government offices. In accordance with Georgia Law OCGA 48-5-2641 property owners and occupants are notified that appraisers from the Tax Assessors office routinely review all properties within the county. Tag Office hours 800am 430pm.

Coweta County Board of Commissioners - 22 East Broad Street Newnan GA. Every holder of a long-term note secured by real estate must have the security instrument recorded in the county where the real estate is located within 90 days.

Geographic Information Systems Gis Coweta County Ga Website

C D Landfill Coweta County Ga Website

Coweta Living 2017 2018 By The Times Herald Issuu

Closing Costs Michael Raab Your Coweta County Realtor

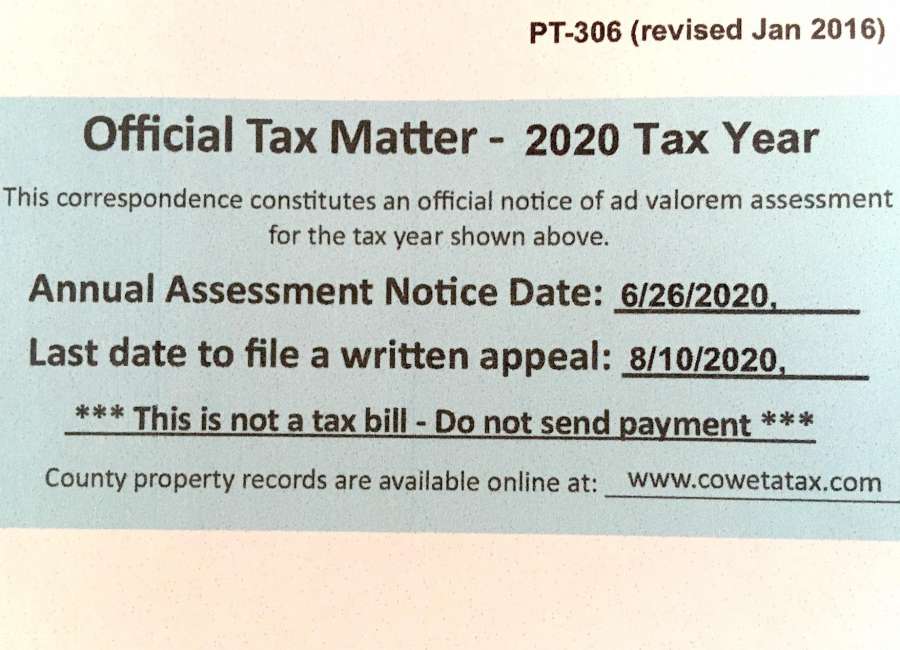

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Coweta County Ga Hallock Law Llc Property Tax Appeals

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

Boating Coweta County Ga Website