likelihood of capital gains tax increase in 2021

The lifetime capital gains exemption is 892218 in. Aug 15 2021 450AM EDT.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

. The top rate would jump to 396 from 20. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate. However it was struck down in March 2022.

President Biden will propose a capital gains tax increase for households making more than 1 million per year. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. While it is unknown what the final legislation may contain the elimination of a rate.

Read this guide to learn ways to avoid running out of money in retirement. The Covid-19 crisis has exacerbated the need to raise additional tax revenues and an increase in CGT rates wont break the governments. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

It would also nearly double taxes on capital gains to 396 for people earning more than 1 million. Ad Learn ways dividends can help generate income in this free retirement investment guide. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

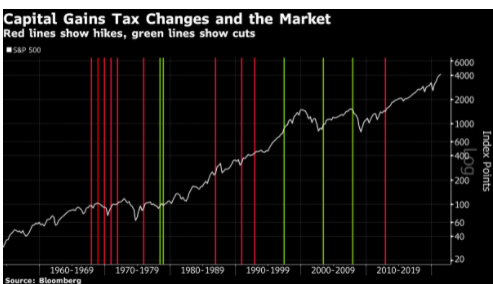

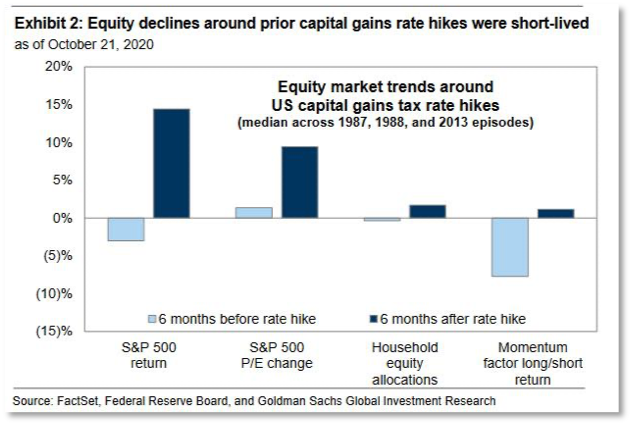

Or sold a home this past year you might be wondering how to avoid tax on capital gains. The Chancellor will announce the next Budget on 3 March 2021. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987.

The current capital gain tax rate for wealthy investors is 20. Many speculate that he will increase the rates of capital. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

Ad If youre one of the millions of Americans who invested in stocks. Implications for business owners. That would be the highest tax rate on investment gains which are mostly paid.

Note that short-term capital gains taxes are even higher. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Published on 22nd Jan 2021.

Capital Gains Taxes Proposed Increase For The Ultra Wealthy An Overview For The Rest Of Us Investors Don T Mess With Taxes

New Tax Initiatives Could Be Unveiled Commerce Trust Company

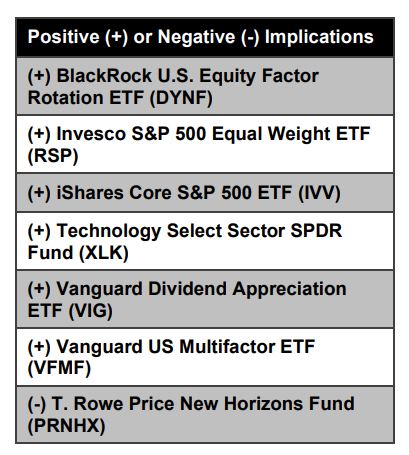

Possible Changes In Tax Policy Could Further Drive Etf Usage

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Capital Gains Trade Nears Potential Deadline As Legislation Looms

How The Biden Tax Plan Will Impact The Economy

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

Tax Implications Of The 2020 Elections On Agency Sales Agency Brokerage Consultants

Effects Of Changing Tax Policy On Commercial Real Estate

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Business Capital Gains And Dividends Taxes Tax Foundation

Wealthy Would Dodge 90 Of Biden S Capital Gains Tax Increase Study Says Cbs News

How You Might Prepare For Higher U S Taxes Chase Com

Congress Readies New Round Of Tax Increases

Short Term Capital Gains Tax Rates For 2022 Smartasset

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)